Airbus is a prominent European aerospace company that creates, produces, and markets space systems, helicopters, and commercial airplanes. Since its founding in 1970, Airbus has grown to rank among the biggest and most well-known companies in the world’s aerospace sector.

Learn Everything There Is To Know About Airbus SWOT Analysis—A Leading Global Aerospace Company. Learn About The Advantages, Disadvantages, Opportunities, And Threats That Affect Its Position And Strategic Choices In The Market.

We need a thorough Airbus SWOT analysis to comprehend this!

Visit: Airbus

Airbus SWOT Analysis: Strengths

Broad product offering

Airbus provides a large selection of airplanes, helicopters, and defense and space equipment to meet the needs of different market sectors. By diversifying its product range, the firm may take advantage of growth prospects in various industries and lessen its reliance on any one product line.

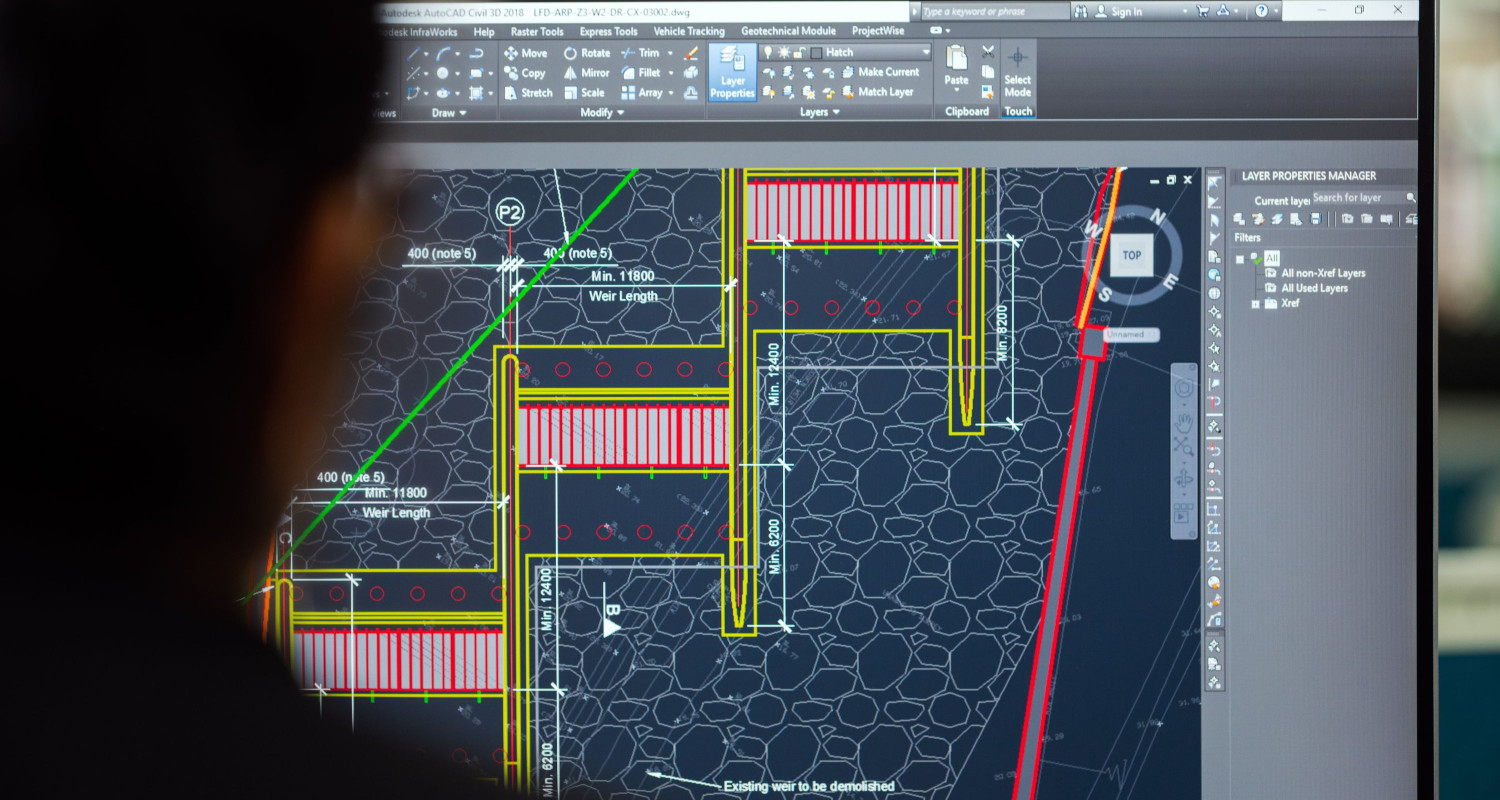

Engineering and inventions

Airbus is renowned for its dedication to R&D, which has resulted in several technical breakthroughs and developments in the aerospace sector.

The firm has been able to fulfill the changing demands of its consumers and stay ahead of the competition by focusing on environmentally friendly solutions, fuel efficiency, and cutting-edge technology.

Robust worldwide reach

Airbus has an extensive global network, encompassing production, engineering, and assembly sites across Europe, the US, China, and Canada. The company’s global reach allows it to access a wide range of markets, foster strong connections with suppliers and consumers, and tap into a worldwide supply chain.

Extensive and diversified clientele

Commercial airlines, governments, defense contractors, and private individuals are just a few of the many groups that Airbus services. This broad consumer base lessens the effect of demand variations from any market niche.

Skilled staff

A powerful name and reputation

Airbus is regarded as a top brand in the aerospace sector with a track record of excellence, innovation, and dependability. The organization can attract talent, partners, and consumers because of its excellent brand image.

After conducting a brand review 2018, Airbus reran the research in 2021 and found that the brand’s financial worth had grown from €9.85 billion to €12.2 billion, a 24% increase.

Collaborations and strategic alliances

Airbus has a track record of establishing alliances with essential suppliers, research institutes, and industry members. Through these partnerships, the business may exchange knowledge, pool resources, and have access to new markets and technological advancements.

See Also: SWOT Analysis of Southwest Airlines

Weaknesses

Reliance on vendors

Airbus depends on a sophisticated network of suppliers for the parts and components utilized in its products. Any hiccup or delay in the supply chain might impact the company’s reputation, raise expenses, and shorten the production schedule.

High expenses for research & development

The aerospace sector requires constant innovation and advancement in technology and products. Although Airbus’s dedication to research and development has helped the company succeed, its high expenses can hurt its bottom line.

The cyclical character of the sector

The aerospace sector is well-known for its cyclical nature, with the demand for airplanes being significantly impacted by variables, including the state of the world economy, the price of fuel, and governmental laws. The cyclical nature of demand may cause Airbus’s earnings to fluctuate.

Spirited rivalry

Other significant Airbus competitors in the aerospace sector, like Boeing, Bombardier, and Embraer, compete fiercely with Airbus. Due to this rivalry, Airbus’s market cap and profitability may be impacted by price wars, higher R&D expenses, and pressure to innovate.

Threats from geopolitics

Due to its global presence, Airbus is subject to geopolitical risks, including trade disputes, legislative changes, and political unrest in its business areas. These risks may impact the company’s supply chain, clientele, and general business operations.

Big initiatives and intricacy

Large-scale projects that Airbus works on, including creating and manufacturing new aircraft types, can have severe delays, cost overruns, and technical difficulties.

The company’s reputation and financial success may be impacted by these difficulties.

Environmental issues

Opportunities

Rising desire for flying travel

Growing urbanization, increased disposable incomes, and expanded tourism are predicted to fuel the worldwide demand for air travel. Due to this expansion, Airbus can raise its market share and boost commercial aircraft sales.

Developing economies

Demand for air travel is rising quickly in emerging economies, especially Asia and Africa. These areas allow Airbus to expand its clientele and broaden its income streams.

Emphasize sustainability and fuel economy.

Growing fuel prices and environmental concerns drive the need for more environmentally friendly and fuel-efficient aircraft.

By investing in cutting-edge technology that increases fuel economy and lowers emissions, Airbus can profit from this trend and establish itself as a pioneer in environmentally friendly aviation.

Growing the services industry

Airbus can grow its services business even further by providing clients with a wide range of support services, including maintenance, training, and digital solutions. This will improve client connections and brand loyalty while generating new income sources.

Urban aerial mobility with unmanned aerial vehicles (UAVs)

Due to the increasing demand for these products, Airbus could expand into new markets and create cutting-edge goods in the UAV and urban air mobility sectors. Acquisitions, internal R&D projects, and strategic collaborations can all help achieve this.

Satellite technology and space exploration

Airbus’s Defence and Space division may see development prospects due to the increased interest in space exploration and the expanding market for satellite-based services like communication and earth observation.

Purchases and mergers

Airbus can engage in strategic mergers and acquisitions to broaden its range of products, break into untapped markets, or get key technologies and intellectual property. This will support long-term growth and enhance its competitive position.

See Also: 19 Best MLM Companies To Join in 2024

Threats

Fierce rivalry

Significant competitors like Boeing, Bombardier, and Embraer are constantly vying for market share in the very competitive business in which Airbus operates.

Price wars, narrowed profit margins, and the need for constant innovation to stay ahead might result from increased competition.

Geopolitical dangers and economic downturns

The aerospace sector is susceptible to economic downturns due to its cyclical nature and susceptibility to global economic conditions. Geopolitical risks can also affect Airbus’s supply chain, customer connections, and general operations. Examples of these risks include trade conflicts and political instability.

Rules about the environment and public scrutiny

According to Airbus SWOT analysis, there is growing pressure on the aircraft sector to lessen its adverse environmental effects, especially concerning noise pollution and carbon emissions. Tighter laws and public scrutiny may result in higher expenses, possible fines, and reputational hazards for Airbus.

Disruptions to the supply chain

Airbus depends on a sophisticated network of suppliers for the parts and components utilized in its products. Any disruption or delay in the supply chain may harm the company’s reputation, raise expenses, and shorten the production schedule.

Innovations in technology and obsolescence

In the aerospace sector, rapid technical breakthroughs can potentially obsolete existing goods and technology. According to Airbus SWOT analysis Airbus must constantly invest in research and development to maintain its competitive edge and guarantee that its product line stays current.

Cybersecurity risks

Due to its growing reliance on linked systems and digital technologies, Airbus is more susceptible to cybersecurity attacks.

Cyberattacks can cause operations to be disrupted, sensitive data to be lost, and reputational harm.

See Also: SWOT Analysis of American Airlines: Overview and Key Points

FAQs

To maximize performance, how might Airbus use its strengths in the Airbus SWOT analysis?

Airbus can seize opportunities by using its capabilities. To address the rising demand for sustainable aviation, for instance, its strong brand and inventive skills may be used to produce eco-friendly aircraft.

What plans of action can Airbus take to strengthen the areas where the Airbus SWOT analysis shows weakness?

Airbus can create plans to lessen or get around its flaws. For example, it may boost its financial situation, increase the robustness of its supply chain, or optimize manufacturing procedures.

In what ways does Airbus counteract the risks found in a SWOT analysis?

Airbus can use tactics like broadening its range of products to lessen its reliance on a particular market, monitoring industry trends closely, and keeping production flexible to react to changing economic conditions.

Conclusion

Airbus is a powerful force in the world aerospace market thanks to its exceptional capabilities and tactical advantages. Strong worldwide ties and a commitment to robust R&D enable Airbus to produce high-caliber, innovative products continually.

Its broad customer base and significant market share offer stability and durability in a cutthroat industry. The company’s offers and skills are further enhanced through its strategic alliances.

Furthermore, Airbus has developed a remarkable reputation as a brand, emerging as a symbol of quality and reliability.

However, it also confronts vulnerabilities and dangers, including historical bribery, environmental issues, fierce rivalry, and cybersecurity risks.

However, Airbus has seen chances to fund unmanned aerial systems, investigate new markets, grow in the space and defense industries, and take advantage of the growing popularity of air travel. Airbus can survive and retain its position as the world’s leading aerospace company by taking advantage of these chances and overcoming obstacles.

See Also: How to do Competitor SWOT Analysis? 101 Guide