Boeing SWOT analysis Aviation is one of the most sophisticated and developing industries. Moreover, many aerospace companies are present in this sector. However, Boeing holds the second-largest market share in the aircraft industry. Also, The Boeing SWOT analysis portrays the overall market position of Boeing.

Boeing’s SWOT analysis reveals that Boeing has expanded its business into multiple sectors. They have come up with a very efficient blockchain system. Managing significant capital and vertical integrations is one of the essential takeaways from Boeing’s SWOT analysis.

This article will give you a brief idea about Boeing’s business model and its strategies. Read further if you want to know the brand’s Strengths, Weaknesses, Opportunities, and Threats in detail. For more details, you may visit Boeing’s SWOT analysis and also learn the major benefits of SWOT analysis.

Boeing SWOT Analysis

The aviation industry requires a lot of constant capital. So, it is tough to be among the top players. This industry demands continuous innovation and optimization. Let’s look at all the factors that affect Boeing’s business model and strategy.

Let’s look at all the factors that affect Boeing’s business model and strategy.

Strengths

S in Boeing SWOT Analysis , denotes strengths of the company . So here are the strengths of the company .

Consistent Brand Reputation

Boeing is one of the most consistent and reliable manufacturers. They supply parts all over the world. They manufacture good quality products for private companies as well as government projects. Hence, they can attract and retain most of their customers, which is crucial for any brand. The SWOT analysis of American Airlines is the perfect airline swot analysis example, as we can see how vital brand recognition is.

They supply parts all over the world. They manufacture good quality products for private companies as well as government projects. Hence, they can attract and retain most of their customers, which is crucial for any brand. The SWOT analysis of American Airlines is the perfect airline swot analysis example, as we can see how vital brand recognition is.

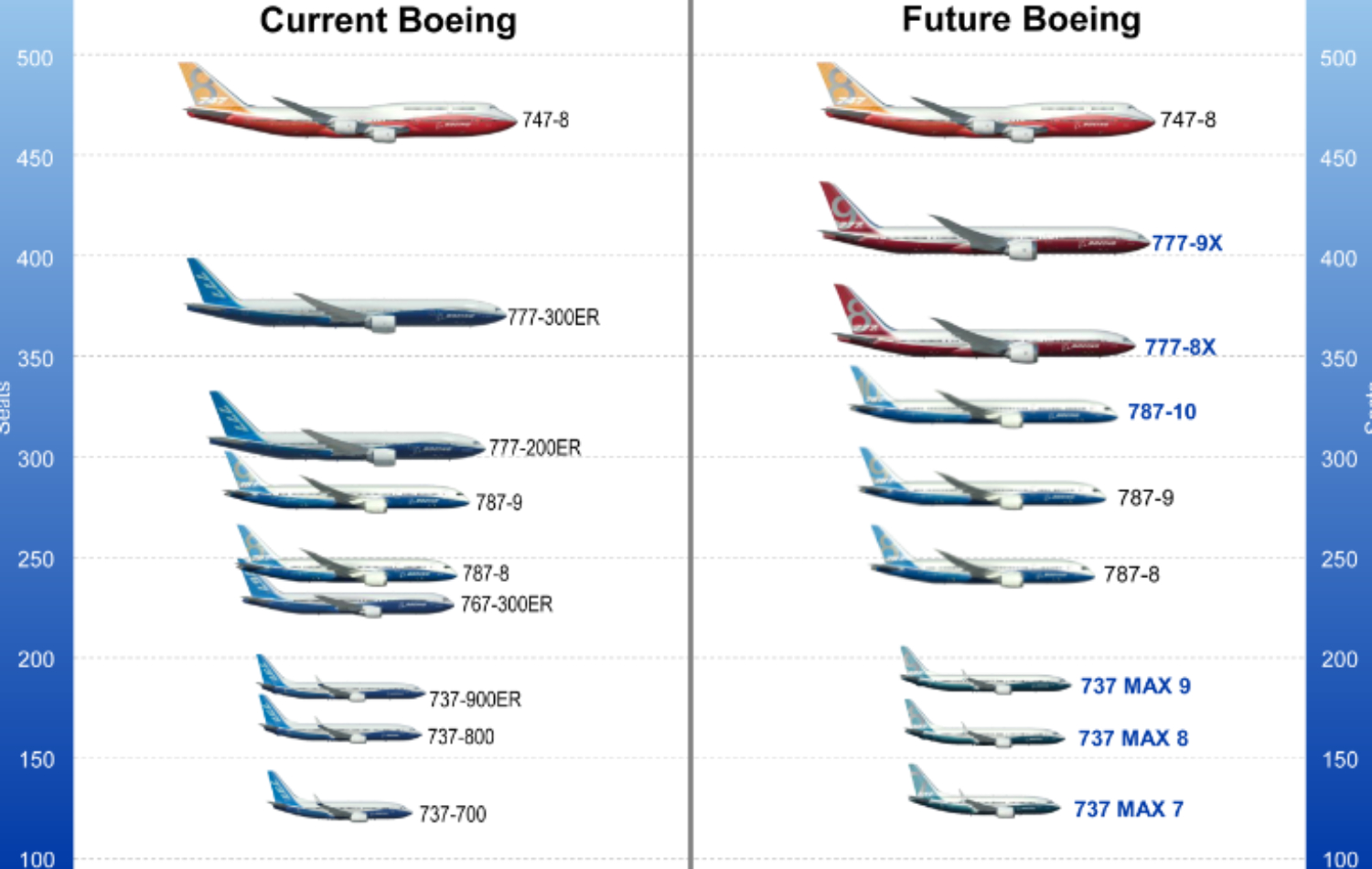

Diversified Range of Products

Boeing is not only a commercial aircraft manufacturer but is also involved in many other industries. It manufactures military jets and defense weapons for various governments. Moreover, it also makes satellites and parts for space-oriented missions.

It manufactures military jets and defense weapons for various governments. Moreover, it also makes satellites and parts for space-oriented missions.

Globalization

Boeing has clients all around the world. It manufactures parts and systems for around 150 countries. This gives Boeing more revenue to the company. Thus, it can compete with its rival companies.

Research and Development

Boeing spends a lot of funds on Research and Development. Over time, it has worked on increasing fuel efficiency and automation and using better material substitutes. This quality makes contract Boeing a better option than rival companies.

This quality makes contract Boeing a better option than rival companies.

Quality of Workforce

Boeing hires a lot of skilled engineers through a challenging and unique process. It has hired some of the best R&D researchers and design teams. Boeing organizes a lot of competitions and events to find skilled individuals.

It has hired some of the best R&D researchers and design teams. Boeing organizes a lot of competitions and events to find skilled individuals.

Partnerships and Collaborations

Boeing often collaborates with some recognized companies and makes use of their resources.

Boeing partnered with Lufthansa and Etihad Airways. The SWOT analysis of Southwest Airlines shows how much they rely on Boeing for aircraft. It partnered with Google to use its cloud computing facilities and AI tools.

Boeing partnered with Lufthansa and Etihad Airways. The SWOT analysis of Southwest Airlines shows how much they rely on Boeing for aircraft. It partnered with Google to use its cloud computing facilities and AI tools.

Weaknesses

Here W in Boeing SWOT Analysis denotes weaknesses of the company .

Reliability Issues

The Boeing 737 MAX crash caused many questions about the company’s reliability.

The crash occurred due to the need for more thorough aircraft testing. This event has resulted in many contracts being pulled from the company. Boeing’s customers need more clarification about the safety of its products.

The crash occurred due to the need for more thorough aircraft testing. This event has resulted in many contracts being pulled from the company. Boeing’s customers need more clarification about the safety of its products.

Blockchain Issues

Boeing manufactures and imports materials from many different parts of the world. So this makes the company prone to a lot of delays as well as increased costs. Due to the external parts manufacturing, Boeing needs help maintaining the quality. Thus, the customers often need to be more satisfied with the final product due to such quality issues.

Low Margins

Boeing focuses a lot on defense and government contracts.

These contracts have a fixed price, resulting in lower profit margins Sometimes, the cost prediction needs to be corrected, and the project results in a loss for the company.

Depending on the Commercial Aircraft Industry

Most of Boeing’s revenue comes from commercial aircraft manufacturing. The vertical integrations of Boeing are less successful than aircraft manufacturing. This makes Boeing weaker than the rival companies.

Increasing Competition

Boeing’s revenue has taken a massive dip as many rival companies have entered the commercial aircraft industry. Air has affected Boeing’s revenue the most. Due to this, Boeing’s profits and revenue have decreased significantly. From the SWOT analysis of Airbus, we can find out how Boeing and Airbus compete for market share.

Air has affected Boeing’s revenue the most. Due to this, Boeing’s profits and revenue have decreased significantly. From the SWOT analysis of Airbus, we can find out how Boeing and Airbus compete for market share.

Changing Policies and Regulations

Boeing has to deal with a lot of rules and regulations. The manufacturing of commercial aircraft has a lot of strict rules and regulations which keep on changing from time to time.

Due to this, the company has to bear a lot of extra costs. Sometimes, in the middle of the manufacturing process. So, this costs the company a lot of extra money and lowers the profit.

Environmental Effects

Boeing owns a lot of factories and manufacturing plants. So, it produces a lot of pollution. Over time, Boeing has received a lot of criticism for not being environmentally friendly.

Moreover, the aviation industry has started to prefer environment-friendly fuel and is working towards electric jets and aircraft. Thus, Boeing must work on new and environmentally friendly aircraft and products.

Moreover, the aviation industry has started to prefer environment-friendly fuel and is working towards electric jets and aircraft. Thus, Boeing must work on new and environmentally friendly aircraft and products.

Opportunities (Boeing SWOT analysis)

Here O in Boeing SWOT Analysis denotes opportunities that company can grab . So are the opportunities for Boeing .

Potential Increase in Air Travel

With time, the air travel industry has grown steadily. Hence, the demand for air travel will increase considerably in the coming years. So, Boeing has an excellent opportunity to increase its profits and revenue.

Hence, the demand for air travel will increase considerably in the coming years. So, Boeing has an excellent opportunity to increase its profits and revenue.

Diversification

Boeing is not so dominant in sectors other than commercial aircraft manufacturing. So, Boeing can strategically partner with other companies and increase their revenue in other fields.

They can pay more attention to digital marketing to make their brand more popular and increase revenue. Airbnb’s digital marketing campaign is a perfect example of how to increase revenue and popularity.

Automation and Manufacturing Efficiency

There is a lot of automation taking place in the manufacturing industry. Automated machines are faster and cause less error. They also save money compared to human labor.

So, decreasing the manufacturing cost and reducing the production time will help increase the company’s profits. The customers will also appreciate quicker delivery and high-quality products from Boeing.

Sustainable Products

Boeing can innovate and develop environment-friendly technology to gain an advantage over rival companies.

Governments prefer sustainable goods. Thus, being sustainable will give Boeing more business and help increase profits.

Autonomous Vehicles and Satellites

Uncrewed Aerial Vehicles are becoming very popular in the defense sector. So, Boeing can make these vehicles commercially for governments and occupy a significant market share.Similarly, satellite and space-oriented missions are being developed by many countries. Boeing has a chance to increase its market share in the space industry.

Threats

T in Boeing SWOT Analysis denotes Threats .

Rival Companies

Companies like Airbus can offer better services and products than Boeing.

Airbus has more market share than Boeing in the commercial aircraft industry. Due to rival companies, future profits and revenue can decrease significantly.

Global Policies and Political Problems

Boeing deals with customers from many different countries all around the world. But, due to rivalries between countries, political pressure can be on the company. Hence, business relationships with the government of one country can affect the business with other countries. Thus, political problems worldwide can decrease the company’s revenue.

Blockchain Management Problems

Boeing has a highly complex manufacturing layout. It outsources most of its manufacturing contracts. Due to natural calamities, manufacturing will be affected, which will cause delays in the projects.

This can lead to problems in blockchain management. Moreover, due to the pandemic, the travel industry was shut down. Due to this, the company’s revenue decreased significantly.

Reputation in Market

Due to the Boeing 737 MAX crashes, Boeing’s reputation has decreased a lot. Customers want their products to be safe and functional. So, this lack of trust can decrease Boeing’s business. Potential contracts and orders can be canceled due to trust issues with customers. Thus, Boeing’s revenue can be affected.

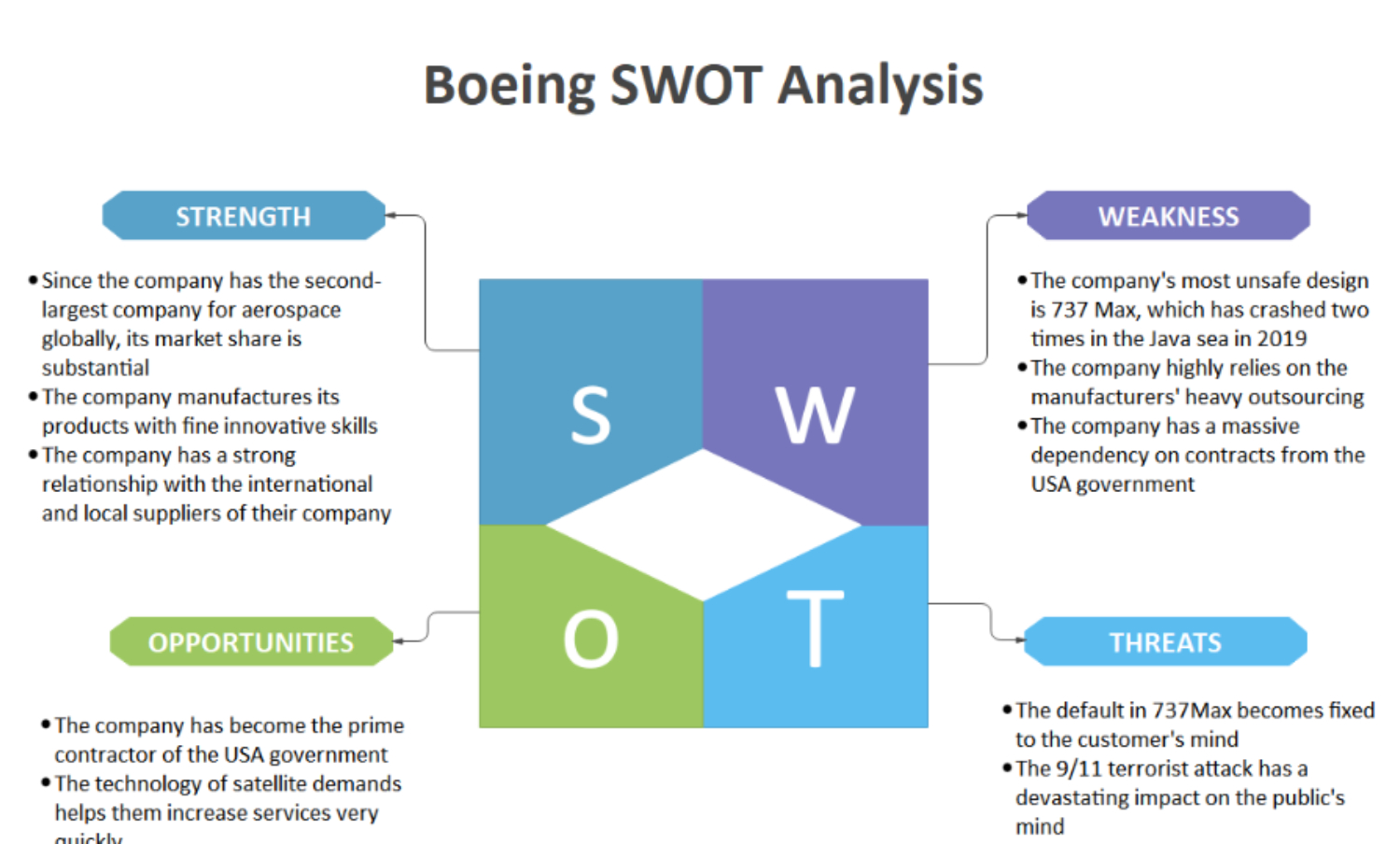

Boeing SWOT Analysis Diagram

Let’s take a look at the Boeing Swot analysis via a diagram.

FAQs

What is Boeing's competitive advantage?

According to swot analysis of Boeing, we can say that the strengths of Boeing are reputation, diverse product range, global presence, and partnerships.

What is 8 box swot analysis?

The 8 box swot analysis refers to the matrix that connects strengths and weaknesses to opportunities and threats

Who is the rival of Boeing?

According to the swot analysis of Boeing and airbus, we can find out that Airbus has a lot of common business sectors with Boeing and they are the two biggest players in the commercial aviation industry.

What are the core values of Boeing?

According to the Boeing company swot analysis, the core values of Boeing are reliability, quality, constant innovation, and global outreach.

Conclusion

The Boeing SWOT analysis reveals that the company has to improve its reputation. Moreover, the company must continue introducing innovations and technology to maintain its strength and utilize opportunities. Currently, the company is on a path of steady growth and has a lot of opportunities to look forward to.

Overall, Best Buy’s SWOT analysis provides valuable insights into the company’s position in the market and helps inform strategic decision-making for future success