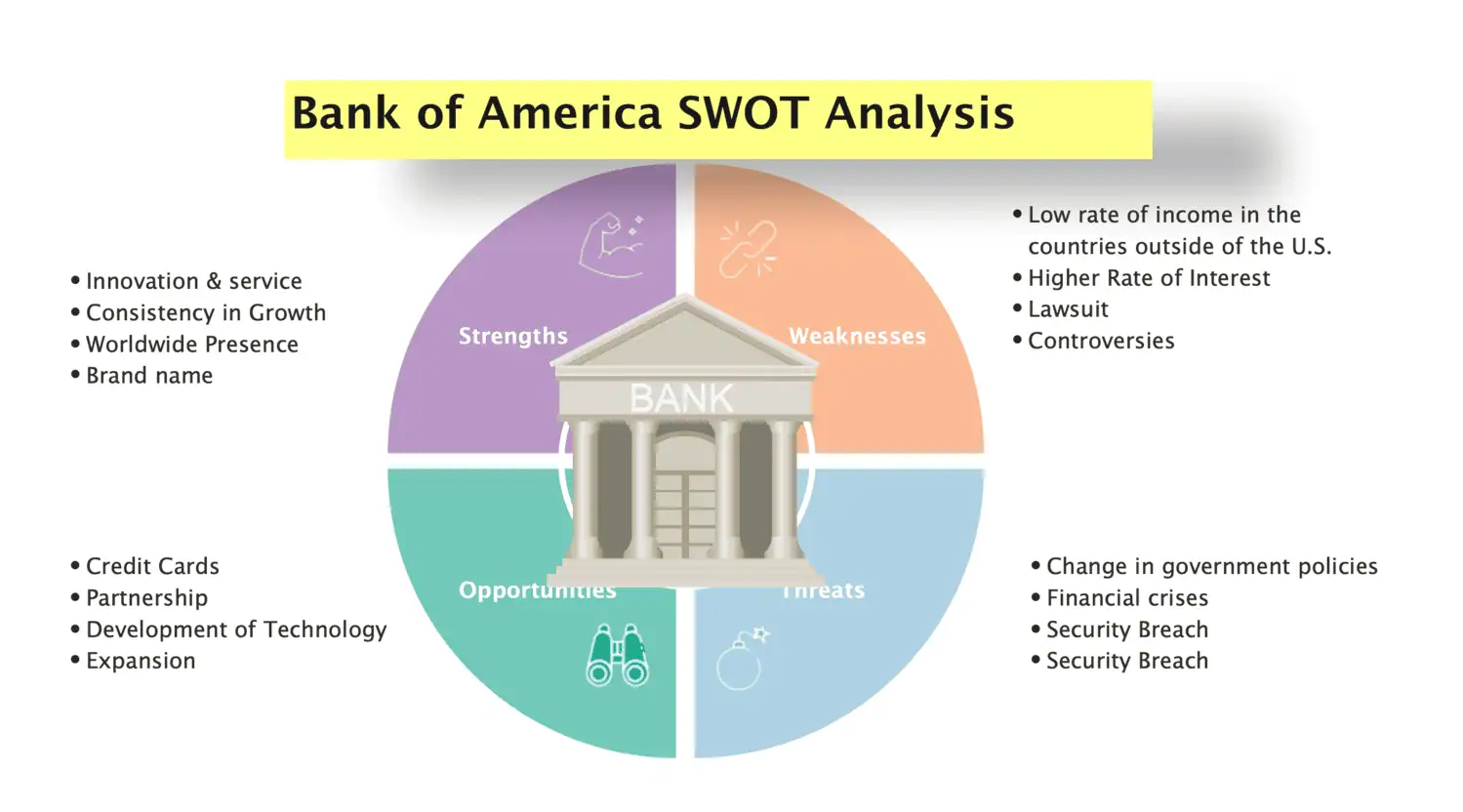

Using the Bank of America SWOT analysis research, one may quickly determine the internal and external elements affecting the organization. This article will discuss the Bank of America SWOT analysis.

The Bank of America SWOT analysis analyzes the company’s image regarding its internal variables, such as strengths and weaknesses, and external aspects, such as opportunities and threats.

Learn more about Bank of America’s SWOT analysis by reading on.

Visit: Bank of America

Bank of America SWOT Analysis 2024

Here is a Bank of America SWOT analysis:

Strengths

Here are Bank of America’s strengths:

Superior value for the brand

The superior brand value of BofA is indicated by estimates that put it at $38.6 billion in 2022, an increase from $36.7 billion in 2021. Additionally, due to its excellent brand awareness, sizable market share, and devoted client base, Forbes placed it as the 86th greatest brand in the entire globe in America’s Best Bank 2023.

Successful Operation

Bank of America has successfully operated through solid revenue growth and good services. The bank has continuously generated good profitability, with a net income of $26.015B in 2022. Through the use of new technologies and enhanced business procedures, it has also increased efficiency while lowering costs.

Outstanding Service

The bank has made significant technological investments to enhance the client experience and provides a variety of practical banking choices, including mobile and Internet banking.

Regular Innovation

Bank of America has constantly invested in innovation to enhance customer service and boost productivity. The bank enhanced its online banking features and unveiled Erica, an artificial intelligence-powered virtual financial advisor.

Bank of America was awarded for emphasizing technology to improve client experience and develop new business prospects as one of the giant innovative corporations in 2022.

See also: SWOT Analysis of American Airlines: Overview and Key Points

Weaknesses

Here are the weaknesses:

Charge at a High Rate

Compared to other financial organizations, Bank of America is noted for having high credit card and loan interest rates. Some credit cards from BofA carry interest rates of up to 25%. Furthermore, the average interest rate on an individual loan from Bank of America is close to 11%, more than the 9.41% national average. As a result, it is harder for consumers to keep up with their debt, and they may end up looking for less expensive options.

Inequitable Revenue

The USA market accounts for over 35% of the bank’s total income, even though it operates in over 35 nations. Customer banking accounted for 46% of the bank’s overall revenue, while worldwide wealth and investment management provided 22%. This unbalanced income distribution makes the bank sensitive to customer behavior and economic situation alterations.

Global presence is low

Bank of America has a comparatively small global footprint compared to its rivals. Despite the bank’s presence in over 35 countries, a small fraction of its activity is abroad. The bank is, therefore, less exposed to the worldwide market than it may be.

Segmentation Limits

As indicated, a sizable portion of their earnings comes from the consumer industry. However, the bank’s emphasis on consumer banking could restrict its capacity to grow in the commercial banking industry. Segmentation can hamper the ability of the bank to expand its income sources and seek development prospects in other sectors.

High operational costs

The enormous branch network of Bank of America, regulatory charges, and technological investments are a few things that contribute to the company’s high operating costs. The bank outperformed numerous rivals, including JPMorgan Chase and Wells Fargo, with noninterest expenditures of $84.084B in 2022, or 72% of total revenue.

Opportunities

Here are the opportunities:

Market enlargement

Since BofA only has outlets in 35 countries, there are plenty of prospects to grow to new markets. To take advantage of the rapidly expanding economies in Asia and Africa and broaden its worldwide reach, Bank of America should look into prospects to extend its company into developing regions.

Partnerships

Fintech is becoming increasingly popular, with a worldwide expansion rate of 19.50%.

Bank of America may partner with fintech firms to provide cutting-edge solutions, get new consumer groups, and remain ahead of the curve in the quickly evolving financial industry.

Digitalization

For Bank of America, the change to digital banking represents a tremendous potential to enhance customer service and attract new clients. To enhance the consumer experience and remain ahead of rivals, they are currently making investments in creating fresh technologies and digital skills.

Sustainable Techniques

The bank may benefit from this trend by increasing its ESG products as interest in social, governance, and environmental investment rises.

In addition to raising awareness of global warming and sustainability issues, they may look at chances to create green bonds, funding for renewable energy, and sustainability-linked loans, among other sustainable finance options.

Strategic acquisitions and mergers

Data from the past suggests that judicious acquisitions and mergers assisted Bank of America in growing its company lines and share of the market. The bank made several acquisitions to boost productivity and improve client service.

Threats

Here are the threats of the Bank of America SWOT analysis:

Economic instability

Recessions and other economic crises can result in less demand for banking services and more loan defaults, affecting the bank’s earnings and profits. Thus, The bank is already experiencing financial difficulties and bracing for the worst to deal with the 2023 recession.

A lot of opposition

Bank of America now confronts more incredible rivalry in the financial sector as significant banks fight for market share. They lost $52 billion in market value in 2023 alone while attempting to maintain market share.

Staffing Issues

Recently, the bank has had several widespread internal and external staff concerns. Additionally, the staff needs to be more diverse, which costs the bank trillions of dollars yearly in various ways. Regarding the initiative, they are looking for people to add to senior management to address the issue.

Internet security risks

As a sizable financial company, Bank of America is vulnerable to cybersecurity risks like data hacking and identity theft. The bank is investing $1B in cyber defense due to a lawsuit it suffered following an attack on data that revealed the private data of over 100,000 clients a few years ago.

See Also: Airbus SWOT Analysis: Flying High with Success

FAQs

What is a Bank of America SWOT analysis?

Bank of America SWOT Analysis evaluates the bank's strengths, threats, weaknesses, and opportunities.

What makes SWOT analysis crucial?

The research carefully pinpoints the company's strengths and weaknesses. On the contrary, it would aid in possible future advancement. The SWOT analysis' external variables include threats and opportunities. Understanding the risks the bank faces is helpful. Additionally, it draws focus on the potential the bank has.

What poses a threat to the American Bank?

In the SWOT analysis, the threat is the external component, which is also a nasty factor since it denotes rival activity, changes in governmental regulations and goods, and other things.

What are Bank of America's weaknesses?

The internal elements that cause the organization to fail are its weaknesses. Using a SWOT analysis of Bank of America, the organization's leadership team may pinpoint its vulnerabilities.

Conclusion

We hope this post about Bank of America’s SWOT analysis is helpful. Considering its extensive international operations, Bank of America ranks fourth among the central banks in the United States. Bank of America’s SWOT analysis is crucial to go forward with great potential.