Are you looking to choose between SumUp and Square for your business? Well then, look no further! In this article, we will discuss the differences between SumUp vs. Square, helping you make an informed decision.

SumUp and Square are leading payment companies. The key differences between SumUp and Square are Customer Base, Market Share, Free Tools, Products, Pricing, Hardware, Card Readers, and POS Features.

Keep reading as we’ll contrast SumUp V/s Square services, evaluating both features and prices so that you can make the best option for your small business.

SumUp

SumUp is a British payments company that offers mobile point-of-sale solutions to small and developing companies.

The simplicity of SumUp is its main selling feature. That is why it is particularly perfect for persons who aren’t automatically denied or for new firms that fundamentally want the ability to accept card installments quickly.

SumUp has one of the cheapest conversion rates and upfront fees for card users accessible. As a result, mainly because there are few decorations or a limited terminal selection. It is popular mainly with independent enterprises with irregular or low-volume trades.

Square

Square POS was more natural and easy to set up than different POS arrangements.

The beneficial thing about Square POS is it isn’t stout and antiquated like numerous POS arrangements available today. Instead, it fills in as an installment stage that permits you to do deals on a versatile application introduce on an iPad.

While Square POS is an excellent fit in one of our organizations, we feel that the absence of seclusion for choices makes it hard to use in the administration business, restricting its utilization to general ventures where actual products are sold.

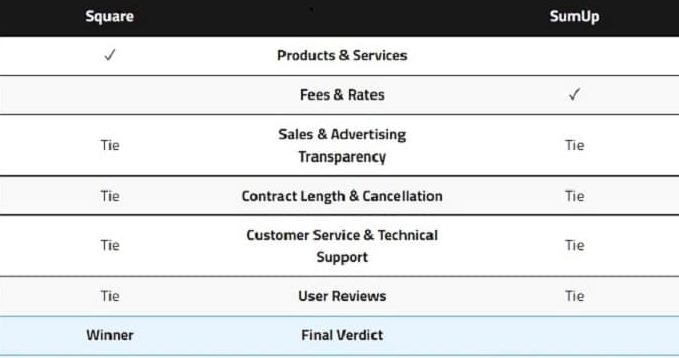

SumUp V/s Square

In this section of SumUp V/s Square, we can say that they are both minimal expense choices for tolerating Mastercard installments.

SumUp and Square both proposition the equipment, programming, and installment handling that permits little organizations to acknowledge installments face to face, invoicing, and via telephone.

While comparing SumUp V/s Square, it is seen that both give minimal expense equipment and installment handling that fit independent companies. Square’s more extravagant assortment of programming abilities can more readily uphold growing ventures as their necessities develop. Also, the best decision for try business visionaries.

SumUp, then again, is a decent choice for firms who underscore keeping costs as low as conceivable above approaching supporting administrations. Because of its basic UI and cheap installment handling rates.

Point Of Differences

Customer Base

When we compare the client bases of Square and SumUp, we discover that Square has 19478 clients while SumUp has 341 clients. Square is ranked top with 19478 clients in the POS Systems category, while SumUp is ranked 24th with 341 clients.

Market Share

Square has a 21.78 percent market share in the POS Systems market, whereas SumUp has a 0.38 percent market share. Square is ranked top in Slintel’s Market Share Ranking Index for the POS Systems class due to its higher pie inclusion, whereas SumUp is ranked 24th.

Free Tools

Square’s essential POS stage has no month-to-month expense and doesn’t need an agreement. While SumUp has expressed desires to send off a POS system. Square has been broadly utilizing it for a drawn-out period. It can deal with errands that SumUp can’t, for instance, standard character check, low-stock alerts, a free electronic shop, and delegate time following.

Products

While Square specializes in products and services such as card payments, point-of-sale software, internet banking, online stores, credit card transactions, business accounts, and funding. SumUp focuses on products and services such as card machines, POS applications, card banking, online stores, credit card processing, business accounts, and finance.  When the two are compare, Square has much more options to provide.

When the two are compare, Square has much more options to provide.

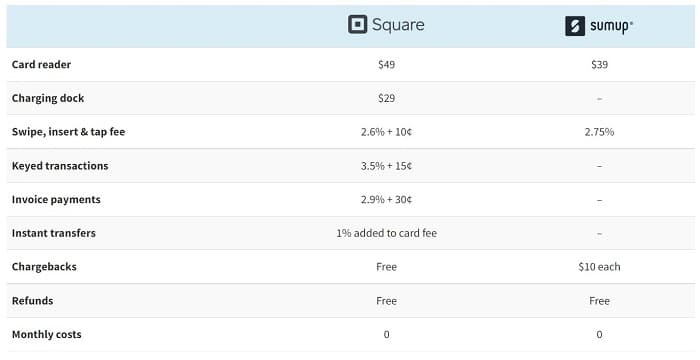

Pricing

SumUp provides a competitive rate of 2.75 percent per swipe, chip, or contactless payment, with additional small installments or invoicing costs. There are still no monthly charges to use their installment administration, although the company charges a one-time fee of $19 for a card per user.

Regardless, Square provides a better value for your money, and they charge 2.6 percent plus $0.10 for every transaction. Although there are several options for upgrading your equipment, the actual stage is provided free of charge.

Hardware

SumUp offers more low-cost options than Square, including three tiny portable devices, two of which feature a free cellular connection. There are, however, no higher-end options, such as a touch-screen terminal.

As previously stated, Square Options include two low-cost card readers that connect to a phone, a mobile portable device with a built-in printer, a tablet stand, and a register with a large touch screen.

Card Readers

The two firms give minimal expense all-inclusive card perusers that can work without extraordinary contraptions. Notwithstanding, SumUp’s inside and out card perusers, the Pro, and the Solo, are more modest and affordable than the Square Terminal.

Besides, while the Square Terminal doesn’t need a different gadget, it requires a Wi-Fi association. If you have a portable residence stand or food truck. You’ll have to sort out how to interface with the web. SumUp keeps away from this issue because of the Pro and Solo capacity anyplace.

Connecting straightforwardly to cell networks with practically zero extra gear or Wi-Fi. Also, it is an enormous accommodation factor for versatile organizations.

POS Features

You get an entire working application with SumUp – however, the Square Point of Sale application has more highlights.

There’s an easy-to-use item index in the SumUp application. Where you can enter item subtleties and pictures. Yet you can add more ascribes in Square’s item library and track stock. Therefore, the SumUp application is ideal for selling direct items or administrations.

Which One Is Right For Your Business

While comparing SumUp V/s Square, we see that both offer the hardware, software, and payment processing necessary for independent companies to accept payments in person, over email, and the phone.

While both firms provide low-cost equipment and payment processing ideal for independent operations. Square’s more comprehensive programming features may more effectively support developing organizations as their demands change. And making it the best choice for aspiring business visionaries.

SumUp, on the other hand, is a solid competitor for companies that emphasize keeping expenditures as low as feasible. Above contacting support administrations because of its easy UI and low installation processing rates.

See also: How to Index a Website on Google Faster (Submit Site to Google Quickly)

Why Choosing Square Is Preferable

Square is a superior option for you for the following reasons:

It Satisfies Complex Requirements

While SumUp primarily targets microbusinesses, first-time entrepreneurs, and freelancers, Square offers a platform capable of supporting small and medium-sized businesses.

Square is undoubtedly the best option for companies that want features like fully functional point-of-sale systems, sizable touch-screen displays, sophisticated reporting capabilities, customer loyalty programs, or marketing help.

Offers Powerful Free Tools

Square’s free basic POS system has no contracts or monthly costs.

SumUp has stated plans to launch a point-of-sale system, whereas Square has been operating for years. SumUp can’t handle activities like bar-code scanning, low-stock notifications, offering a free online store, and employee time monitoring, but this software can. Tap to Pay on iPhone, another service provided by Square, enables business owners to make credit card purchases using just a standard iPhone and the Square POS app. Customers hold their credit cards or iPhone wallets close to the merchant’s phone to make a purchase.

There Is Room To Improve

Because of Square’s modular pricing structure, companies that don’t require many extra services right now can easily add them as their needs change.

The company also sells touch-screen terminals, portable devices with built-in printers, and affordable gear. SumUp only provides more advanced hardware that you could require later.

Reasons Why SumUp Might Be Preferable

SumUp is a good choice because of the following factors:

Readers For Cards Are Independent Of Your Phone

Both businesses provide inexpensive, standalone card readers that can function without using any personal electronics. However, the Pro and Solo all-in-one card readers from SumUp are cheaper and more portable than the Square Terminal.

The Square Terminal needs a Wi-Fi connection even if it does not require a personal device. If you run a mobile company like a food truck or farm stand, you must learn how to connect to the internet. The Pro and Solo of SumUp function anywhere and connect directly to mobile networks without needing additional gear or Wi-Fi, which might be a significant advantage for travel organizations. As a result, this problem is avoided.

It’s Easy And Affordable To Invoice

When customers pay an invoice online, SumUp offers a savings of 15 cents over Square. Though it may not be much, at least it is less expensive. On the back end, you can track unpaid invoices, view a history of transactions for each client, and find out if they have opened your email invoice.

SumUp vs Square: An Overview

Get the highlights of both SumUp and Square from the table below:

| SumUp | Square | |

|---|---|---|

| Monthly fees | None | None – $69 |

| Hardware costs | $19 – $99 | Free – $799 |

| Transaction costs | 2.75% – 3.25% + $0.15 | 2.5% + $0.10 – 2.9% + $0.30 |

| Industry-specific software | Not Industry-tied | Restaurant, retail, and appointments |

| Payment processing | N/A | held by Square Merchant Account |

| Customer service | Customer service by phone and email is available from 9:00 am to 7:00 pm EST. | Customer service is available from 6:00 am to 6:00 pm PDT by phone, email, and chat. |

| Integrations | No | Yes |

| Contract | No lock-in | No lock-in |

FAQs

Is SumUp the same as Square?

The card readers and credit card terminals that SumUp and Square each offer are proprietary and only compatible with their own processing networks. In other words, Square card readers only function with a Square account, while SumUp card readers require a SumUp account to function.

Does SumUp have a monthly fee?

With SumUp, there are no recurring costs and no binding agreements. On a transaction-by-transaction basis, we only impose a little percentage fee. In other words, you only pay after receiving payment.

Conclusion

SumUp V/s Square: A variety of factors influence whether you choose SumUp or Square. SumUp aim at smaller businesses that may not require all of the lavish extras offered by Square. Although the stage does not have as many assets as Square. Its customer care appears to be more focused on resolving concerns.

SumUp is your solution if there is no need for sophisticated cycles. Regardless, it is far from an easy stage to achieve progress. And Square may be a better option if you anticipate growing and driving revenue.