Google Pay is a mobile payment app that enables users to make monetary transactions with just a few clicks. How does Google Pay make money despite being a free app?

Unlike other websites and applications, Google Pay does not make money through its application. Instead, Google Pay earns money through the following:

- Mobile recharge and bill payments commissions

- partnerships with merchants

- Scratch cards and user data.

With over 150 million active users across 40 countries, Google Pay has become one of the most widely used payment platforms. This article provides a complete guide on how Google Pay earns money.

The primary goal of Google Pay is to make it easy for its consumers to send and receive money.

We’ve all used Google Pay for transactions multiple times. But have you ever wondered how Google Pay earns its money without even charging a single penny from a person’s transaction? To answer that question, this article will focus on How does Google pay earn money.

See Also: Top 10 Google Ads Experts to Follow in 2024

Use of Google Pay

In the digital age, digital payments are inevitable. Google’s Google Pay is a mobile payment app that enables a person to pay for or purchase countless things with just one click. It enables users to make monetary payments. Today, it provides a scratch card for each transaction to encourage users to continue using Google Pay.

Life is easier with Google Pay; you no longer need to find money to pay the balance amount to the customer. Let’s now focus again on the question. Google Pay is free; we have to download their free app and start paying or receiving payment from other users. That means Google Pay, unlike some websites and applications, does not make money through their application.

According to reports, Google (Alphabet Inc., Class A) earned $266.74 billion from its website ads in 2021. But that is not the case for Google Pay, and Google Pay does not depend on ads to generate revenue or make many profits.

History of Google Pay (Digital Payments)

Google’s payment platform is Google Pay, an app that supports all Android devices like any other Google service.

They launched in 2011 under the name “Google Wallet,” and later, it was changed to “Android Pay,” which was launched as a replacement for Google Wallet. Now, Google Wallet and Google Pay are the same. Now, they have about 150 active million people users, and they are available across 40 countries globally.

Though Google owns Google Pay, the company does not profit from it as it does from Google Suites.

How do you keep the app running without getting any money?

According to some sources, the company initially planned to charge a 2.9% fee for every debit card transaction but later dropped the plan. It’s completely free of charge.

Now, here are ways for How does Google pay earns money.

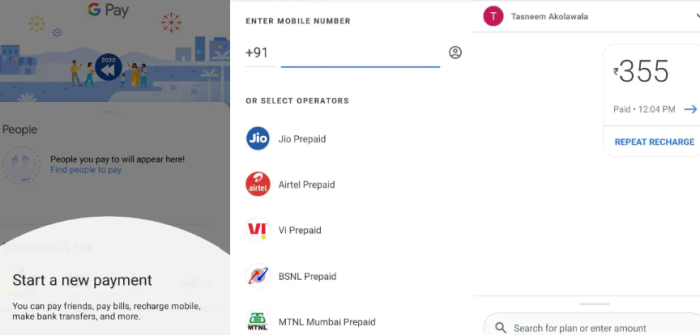

Commission through Mobile Recharge

The answer lies inside the question itself. To begin, most of us recharge our mobile data with Google Pay; When people pay money to get their mobile recharge through the Google Pay app, they will get the money as a commission from their service providers.

Thus they earn money through commissions from telecom service providers such as Airtel and others.

Commission through Bill Payments

When you pay your electricity bills, DTH recharge or cable TV bills, FASTag recharge, Google Pay Store bill payment, gas cylinder booking, broadband or landline bills, postpaid mobile bills, insurance bills, and piped gas bills.

So on, you are using a third-party service. Google pay alerts its user to pay their bills, and they receive a commission every time they pay their bill.

UPI Transactions

In India, UPI (Unified Payments Interface) is the system that adds multiple bank accounts to a mobile application like Google Pay etc. Google Pay does not make money through this unified payment interface, but the app gets paid for the user data. Most people in India use Google Pay for UPI payments, and as a result, they profit from it.

In India, it has a monthly share of 35 percent of UPI volumes and a solidly growing financial services business.

See Also: How Paytm Earns Money? Paytm Business Model?

Scratch cards

Scratch card is a widely used marketing strategy by several websites, such as Google Pay. Initially, it allowed customers to win money as a fun activity. Still, as you may have noticed, Google Pay has begun to feature other e-commerce website offers and encourages you to visit their website to claim the offer.

Now, Google Pay allows users to use merchants that offer cash-back incentives, deals, and discounts, like Burger King and Target.

The respective e-commerce sites and food delivery apps may also compensate them.

Google Pay partnered with MasterCard for card-based payments, allowing in-app transactions through its MasterCard debit and credit cards.

In November 2020, Google Pay revealed that it has partnered with 11 banks for its new mobile banking product, which is known as PLEX.

It works with several other bank partners, including the coastal community, Independence Bank, Green Dot, Harbor Bank of Maryland, and others, to improve their performance, allowing its users to make secure payments without difficulty.

Google supports 43 banks in 22 nations as of 2021. I hope this guide makes it clear on How does Google pay earns money.

See Also: 8 Best Laptops for Digital Marketing in 2024

FAQs

How does Google Pay work?

Google Pay requires you to add or link your bank account to the app. It is now possible to transfer, request, and receive money from the user within a few minutes of linking your accounts. You can even pay by scanning a QR code in shops.

Does Google Pay charge a fee?

No, Google Pay is free. Now, Google Pay has never officially announced that it could charge a fee for user transactions.

Where does Google Pay money go?

If someone sends money to another person, it goes to their bank accounts.

How is Google Pay free?

It is free for its users, but they earn their pay through commissions, like through bill payments like mobile recharge, and their service provides similar functionality to UPI. Though it does not earn much money for the company, it does earn a small amount.

Who is the owner of Google Pay?

Google Pay does not have an owner; technically, it belongs to Google, but its co-founders are Sujith Narayanan and Sumit Gwalani.

Who does UPI belong to?

UPI belongs to the government of India, as it was developed by them (National Payments Corporation of India).

Is a card or bank account required to use Google Pay?

You must add your bank account to use Google Pay. You can move your money whenever you choose, depending on your needs.

See Also: How To Remove Articles From Google?

Conclusion

To wrap up this essay, the response to the question is that it offers free transactions to its clients. Through third parties and their service providers, it does make money. So this is How Google Pay earns money.

See Also: Is Paying For Google Reviews Worth It? | Everything You Need to Know