Business finance is essential to an organization’s development and success. It includes several activities that support managing financial resources and ensuring the proper running of the company. These processes, which range from risk management and investment research to budgeting and financial planning, are essential for forming well-informed judgments and maintaining long-term financial stability. Focusing on allocating corporate money is vital for several reasons beyond meeting your company’s immediate demands. Hence some functions of business finance might be helpful for proper functioning.

The financial functions in a business include- budgeting, financial reporting, managing cash flow, establishing economic facts, marketing, and many more. Firms must comprehend and execute these corporate finance functions to successfully traverse the complicated financial landscape and achieve sustainable development.

Businesses may optimize their financial resources, reduce risks, and increase profitability by utilizing these features, laying the groundwork for success in today’s cutthroat business market. To be a successful entrepreneur and finance manager, first, you need to know the role of business finances more deeply. So lets take a look at the 12 Functions of Business Finance in an Organization.

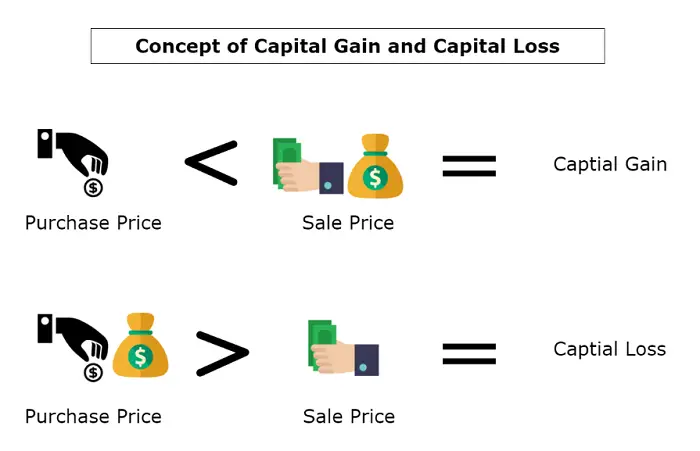

Make Capital Gains

The ability to make a profit is the most important function of corporate finance. At any stage of development, investing in other companies to generate revenue for your firm may be beneficial.

You can invest in stocks as a small business to earn dividends and profits. Increasing your company’s profitability is never hurtful, regardless of your stage of development.

See Also: What is Customer Acquisition Cost? (How to Calculate CAC & Reduce it)

Add Value to Your Business

Although distinct, each financial function’s goals are the same: to properly manage expenses and support businesses and their surroundings.

The success of corporate finance operations has a big impact on how your organization runs day-to-day. As a result, it is also in charge of creating the framework and providing assistance with all aspects of expanding and managing your business.

Fuel Your Current Investments

As a company, you have to take action and invest in resources, experts, or materials. There is also a need for you to provide support for your investments.

Resources need storage, materials require logistical expenditure, and experts need funds. Helping maintain your current investments is one of the functions of finance in business. With business finance, you can sustain your investments in business till it returns profits.

Use it to Avoid Cash Pitfalls

In the United States, only the finest 25% of firms remain in operation for 15 years or longer. The leading cause of most businesses being run to the ground? Not enough capital. To avoid this, you must secure a good business finance plan in all stages of growth.

Recovery From Bad Financial Decisions

Financial mistakes happen, but it is essential to recover from them. If you have invested in the wrong business idea, you need external financing to recover from that decision.

Accordingly, a loan or an angel investment can help you recoup the initial investment, partly or wholly.

Capital Budgeting and Planning

You need a budget supporting several items, from cash amounts to adequate capital allocation in assets or equity. All things considered, business finance functions aid in identifying spending and saving habits that can impede the company’s financial goals.

Aids in Managing and Facilitating Cash Flow

You need to know that business finance is integral to operating cash flow and is not solely responsible for funding business endeavors and properly planning them. Your firm must be able to make wise decisions based on its demands, which is why you need business financing.

See Also: 35 Ways to Increase Conversion Rate? (110% Increased Sales)

Helps Establish Financial Objectives and Plans

It is essential to develop financial goals and objectives that remain until they attain a certain level of profitability. As a matter of fact, Sustaining and developing them is one of the most critical roles played by business finance.

Creating financial plans without having the necessary information and establishing financial goals and objectives will cause chaos. It could also prevent the firm from being profitable hence why you should look for financing.

Business Finance for Loss Analysis and Recoupment

It would be best if you always kept organized books to document, examine, and understand a company’s daily financial activities. In the future, based on your documents, you may decide if there is a capital deficiency. Consequently, struggling businesses may use Business Finance to get the resources required to develop strategies for dealing with loss.

Allows for the Establishment of Financial Facts

Business finance has the advantage that financial results relating to business information may be generated using mathematical or statistical techniques. You evaluate potential candidates associated with aims and objectives for formulas used in external business finance.

You can establish financial facts by judging the economy and whether the market is ready for your idea or product.

Marketing and Promoting

You have a sound company plan and provide an excellent product that customers would be willing to pay for. Nevertheless, nobody will notice you even exist if you do not advertise. Your company can invest loan proceeds in persistent social media marketing and effective SEO tactics to gain brand relevance and profits.

Control of Liabilities and Receivables

Liabilities are equally important as they are part and parcel of every working organization; you need people working  for you. To keep business operations functioning effectively, you need the appropriate level of cash and funding.

for you. To keep business operations functioning effectively, you need the appropriate level of cash and funding.

Even if workers, suppliers, and lenders don’t anticipate a fast payment, you should pay them promptly for their services. It will also help decrease the company’s risk of losing money by failing to pay liability on time.

Frequently Asked Questions

How do I Acquire Business Finance?

There are numerous funding sources to obtain Business Capital, considering bank loans, angel investments, and fundraising. Having a well-qualified loan originator on the team increases your chances of obtaining loans from banks.

What Should I Do if I Am Confused About Corporate Financing?

If you are a startup business owner, think about getting in touch with a broker. Depending on their degree of knowledge, brokers can expose your organization to sources of business finance options.

What is The Best Way to Gain Business Finance?

Save money and put it to use! All of the money is returned to you, and you won't have to pay interest to yourself. The second-best way is through angel investments. Individuals or small groups of executives known as 'angels' make investments in companies, typically through the acquisition of shares.

What are the Benefits of Angel Investors?

Angel investors can contribute resources such as cash, knowledge, and much-needed advice to establish and expand a firm. The best way to progress your business is to obtain angel funding.

What is the Main Disadvantage of Short-Term Business Finance?

Very often, when funding sources notice you require short-term funding, they give you a high-interest loan. These loans might help kickstart your firm, but they can also engulf you in a sea of rapidly rising debt.

How to Prevent Raking Up Debt?

Be smart with your investments; borrow money that you are confident you can pay back. It would help if you comprehended the necessity of repaying your loans as soon as possible to avoid further debt.

What is the Main Disadvantage of Long-Term Business Finance?

Long-term loans offer poor cash flow and higher interest rates. Your monthly cash flow is impacted by long-term loans, which is a significant disadvantage.

Is a Large Long-Term Loan Better Than a Small Short-Term Loan?

This depends on your stage of growth, and most startups prefer short-term loans. If you are a developed company, you may need to loan a big amount. As a result of loaning a large amount, you have more monthly repayment obligations.

Is a Large Long-Term Loan Better Than a Small Short-Term Loan?

This depends on your stage of growth, and most startups prefer short-term loans. If you are a developed company, you may need to loan a big amount. As a result of loaning a large amount, you have more monthly repayment obligations.

What to do After I get Some Business Finance?

Focus on turning the accrued payment into profit. Develop valuable marketing strategies, invest, and promote your trade. Make sure to repay your loans on time. And apply all business finance functions to make the most out of it.

Conclusion

Applying credit to assets or cash to facilitate their return, recoupment, or realization is referred to as finance. A firm uses capital and credit money for commercial purposes as business financing. One of the main roles of finance in business is to assist in maintaining your present investments.

Business finance encompasses all of these activities: making financial projections, acquiring resources, assessing equity opportunities, and loss recoupment. It is crucial for getting startups off the ground and going. Corporate finance is a crucial component of operating cash flow, which is in charge of financing and carefully planning business endeavors.

Business Finance lays the foundation and supports all aspects of developing and sustaining your company. Most business finance functions aid in identifying spending and saving habits that can impede the company’s financial goals. Hard-pressed companies can also use it to get the resources required to develop strategies for dealing with loss. Adapt your firm to new, challenging, and current circumstances to ensure financial security.